Nike has reported financial results for its first quarter, brushing off flat year over year revenue by attributing a decline in North America as a result of its strategic global focus. However, a significant decline in profit from the brand, down 24% from Q1 of last year, can’t be overlooked.

According to Nike, the first quarter of FY18 (ended August 31, 2017) brought an expected decline in North American wholesale revenue, but maintained its growth of revenue in many international markets. Coming in at a total of $9.1 billion, Nike reports zero percent growth across the entire brand compared to Q1 of last year.

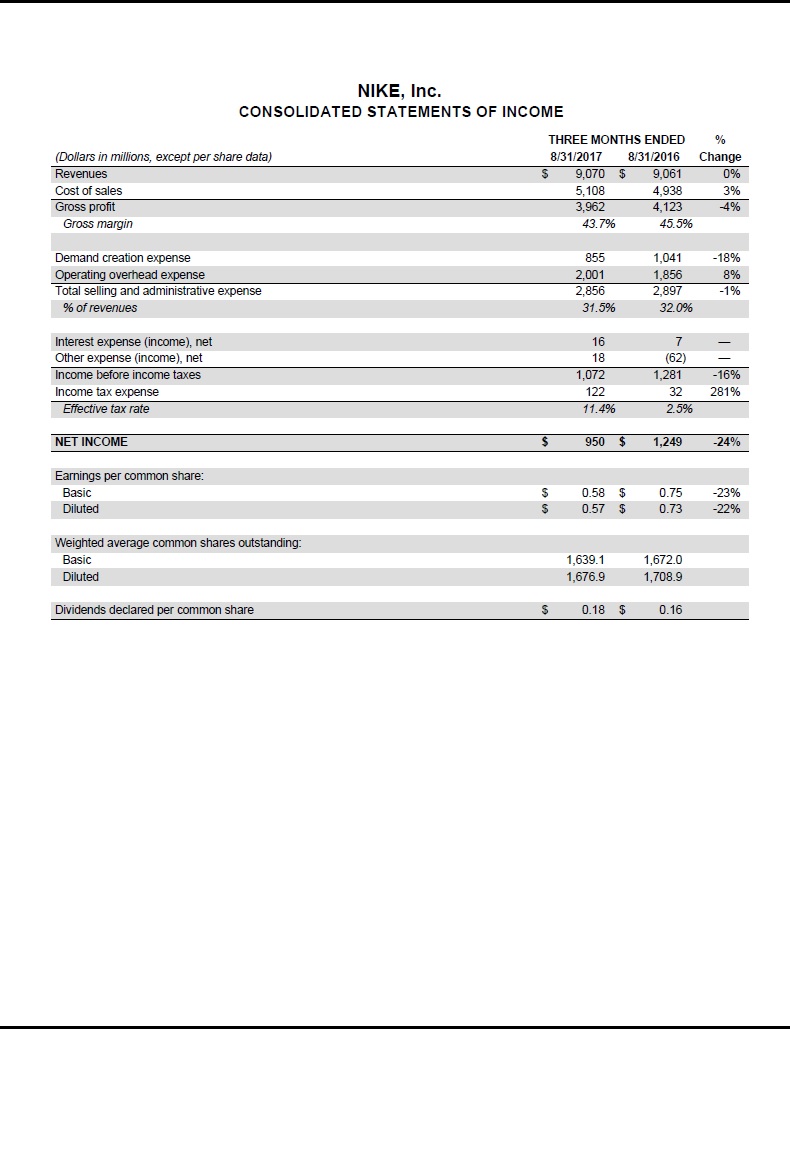

Net income decreased 24 percent to $950 million while diluted earnings per share decreased 22 percent from the prior year to 57 cents.

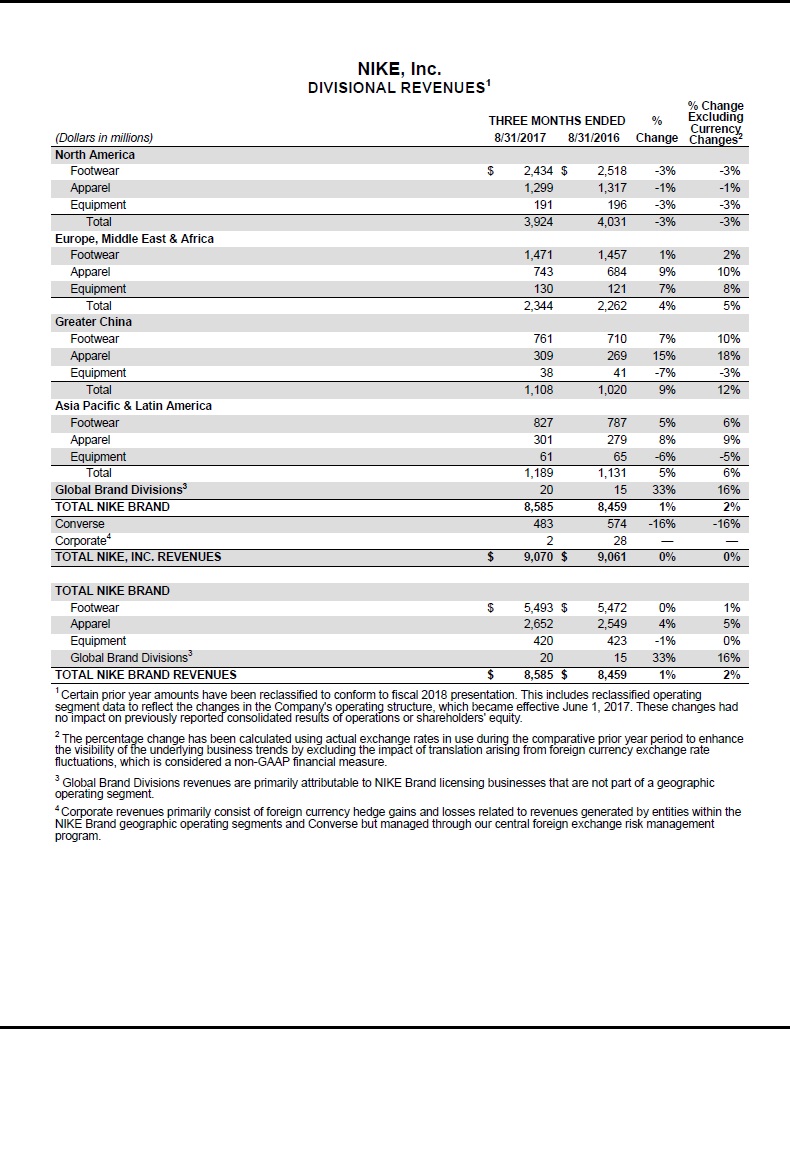

Notably, Converse suffered a loss of 16% in revenue compared to the same period last year at $483 million, which Nike attributed to North American decline. Nike’s biggest area of growth came from the Greater China area as Footwear and Apparel revenue grew 10 and 18 percent, respectively.

It should be noted that in June, Nike stated there would be a shift in the brand’s geographical reporting (scaling back from six geographies to four for reporting). These areas consist of North America; Europe, Middle East & Africa; Greater China; and Asia Pacific & Latin America.

The full fiscal report for Nike’s Q1 2018 can be found below.

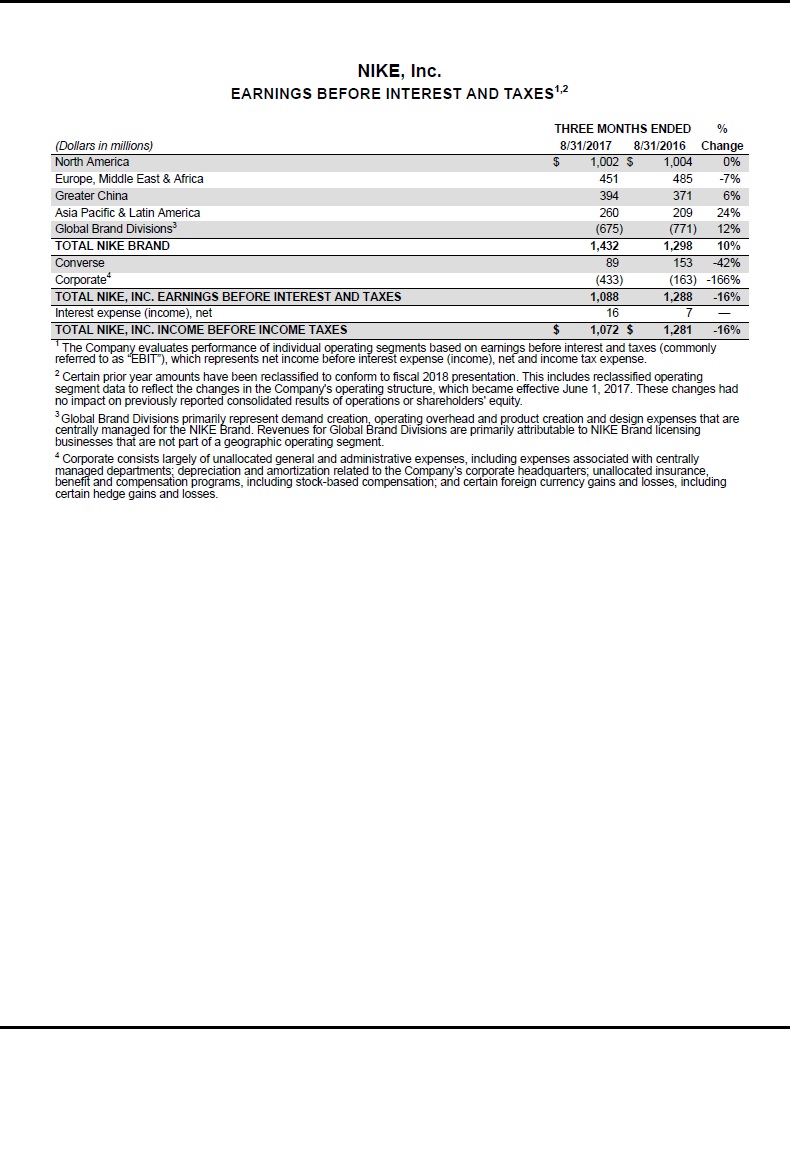

BEAVERTON, Ore., Sept. 26, 2017 – NIKE, Inc. (NYSE:NKE) today reported fiscal 2018 financial results for its first quarter ended August 31, 2017. For the quarter, sustained revenue growth in international geographies and NIKE Direct globally was offset by an expected decline in North America wholesale revenue.

Diluted earnings per share for the quarter were $0.57, down 22 percent driven by a gross margin decline, a higher effective tax rate and higher other expense, net, partially offset by lower selling and administrative expense and a lower average share count.

“This quarter, we captured near-term opportunities through our new Consumer Direct Offense,” said Mark Parker, Chairman, President and CEO, NIKE, Inc. “Looking ahead to the rest of fiscal 2018, we will ignite NIKE’s next horizon of global growth through the strength of our brand, the power of our innovative products and the most personal, digitally-connected experiences in our industry.”*

As previously announced on June 15, 2017, a new company alignment was created as a result of the Consumer Direct Offense which simplified NIKE Brand’s geography structure from six geographies to four consisting of North America; Europe, Middle East & Africa (EMEA); Greater China; and Asia Pacific & Latin America (APLA). The financial results for the NIKE Brand are now reported based on these four operating segments.

FIRST QUARTER INCOME STATEMENT REVIEW

Revenues for NIKE, Inc. were $9.1 billion, flat to prior year on both a reported and currency- neutral basis.**

Revenues for the NIKE Brand were $8.6 billion, up 2 percent on a currency-neutral basis driven by growth in Greater China, EMEA and APLA, including growth in Sportswear. Revenues for Converse were $483 million, down 16 percent on a currency-neutral basis, mainly driven by declines in North America.

Gross margin declined 180 basis points to 43.7 percent due primarily to unfavorable changes in foreign currency exchange rates and, to a lesser extent, a higher mix of off-price sales.

Selling and administrative expense decreased 1 percent to $2.9 billion. Demand creation expense was $855 million, down 18 percent, reflecting higher prior year investments in key sports events. Operating overhead expense increased 8 percent to $2.0 billion driven by realignment costs associated with a previously announced workforce reduction in June and continued investments in NIKE Direct.

Other expense, net was $18 million, primarily comprised of net foreign currency exchange losses.

The effective tax rate was 11.4 percent, compared to 2.5 percent for the same period last year, reflecting the tax benefit from stock-based compensation in the current period as a result of the adoption of Accounting Standards Update 2016-09. The prior year period included a one-time benefit related to the resolution with the IRS of a foreign tax credit matter.

Net income decreased 24 percent to $950 million as lower selling and administrative expense was offset by a gross margin decline, a higher effective tax rate and growth in other expense, net, while diluted earnings per share decreased 22 percent from the prior year to $0.57 reflecting a nearly 2 percent decline in the weighted average diluted common shares outstanding.

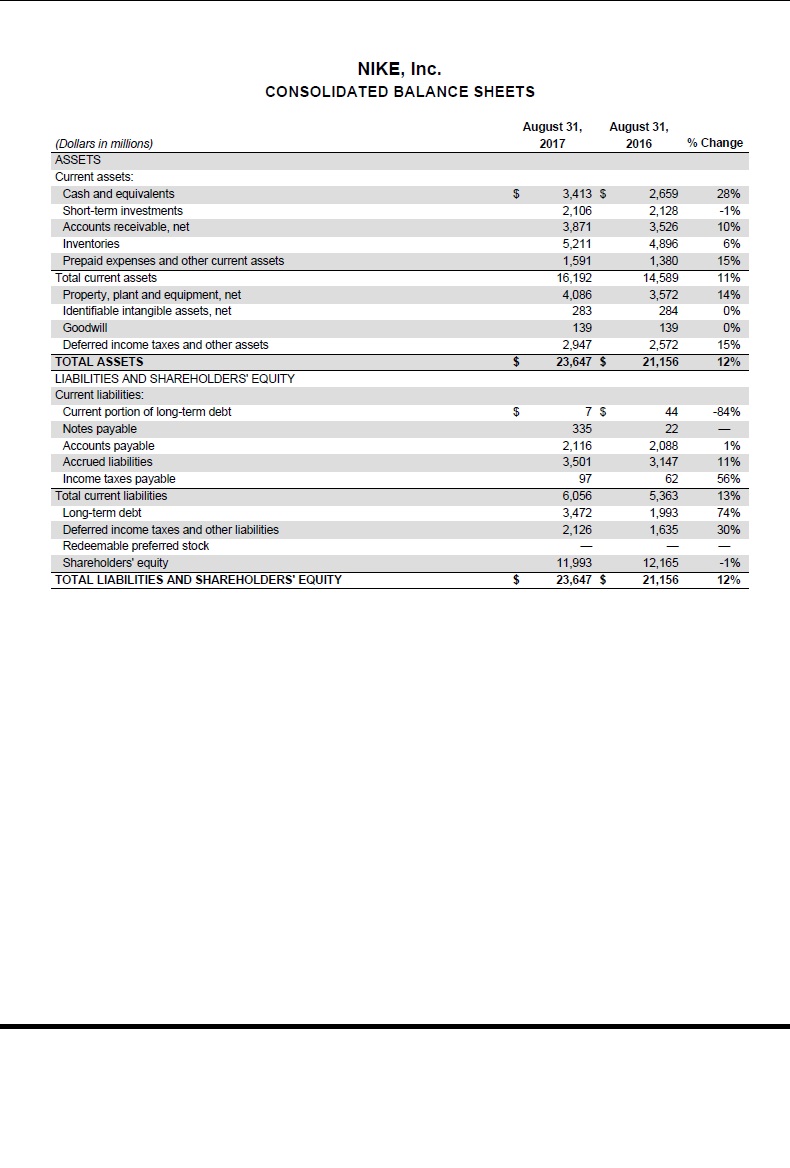

AUGUST 31, 2017 BALANCE SHEET REVIEW

Inventories for NIKE, Inc. were $5.2 billion, up 6 percent from August 31, 2016, driven by a higher average cost per unit primarily due to product mix and, to a lesser extent, changes in foreign currency exchange rates and growth in NIKE Direct businesses.

Cash and equivalents and short-term investments were $5.5 billion, $732 million higher than last year as net income and proceeds from the issuance of debt in the second quarter of fiscal 2017 were partially offset by share repurchases, dividends and investments in infrastructure.

SHARE REPURCHASES

During the first quarter, NIKE, Inc. repurchased a total of 15.3 million shares for approximately $849 million as part of the four-year, $12 billion program approved by the Board of Directors in November 2015. As of August 31, 2017, a total of 95.0 million shares had been repurchased under this program for approximately $5.3 billion.

CONFERENCE CALL

NIKE, Inc. management will host a conference call beginning at approximately 2:00 p.m. PT on September 26, 2017, to review fiscal first quarter results. The conference call will be broadcast live over the Internet and can be accessed at http://investors.nike.com. For those unable to listen to the live broadcast, an archived version will be available at the same location through 9:00 p.m. PT, October 3, 2017.

Source: Nike

Time to bring out the J11 Concords

Time to retro and general release Lebron 1, Soldier 1, Kobe 1, Penny 1, etc. I don’t understand the business logic behind not releasing all the “grails” on a general release. I understand the sneakerhead and hypebeast logic but then the resellers are profiting more than the stockholders lol. Either way Nike CEO are making their millions.

Thats music to my ears, well deserved!