Today New York-based athletic retailer Foot Locker reported financial results for its second quarter ended July 30, 2016.

Highlights

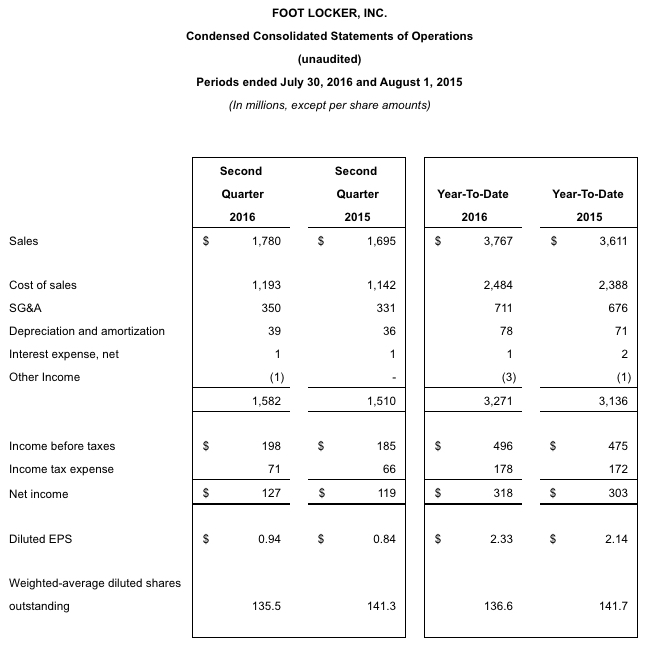

- Net Income Reaches $127 Million

- Earnings Per Share Increases 12 Percent to $0.94

- Comparable-Store Sales Up 4.7 Percent

- Gross Margin Rate Improves 40 Basis Points

Second Quarter Results

Net income for the Company’s second quarter ended July 30, 2016 was $127 million, or $0.94 per share, compared with net income of $119 million, or $0.84per share, last year. Second quarter comparable-store sales increased 4.7 percent. Total sales increased 5.0 percent, to $1,780 million this year, compared with sales of $1,695 million for the corresponding prior-year period. Excluding the effect of foreign currency fluctuations, total sales for the second quarter increased 5.4 percent.

The Company’s gross margin rate improved to 33.0 percent of sales from 32.6 percent a year ago, while the selling, general, and administrative expense rate increased to 19.7 percent of sales from 19.5 percent.

“As a Company, Foot Locker has strong leadership positions in the athletic industry, with the most important being our deep understanding of the core customer for each of our banners,” said Richard Johnson, Chairman of the Board and Chief Executive Officer. “We share this understanding with our key vendors, which enables us to partner with them to deliver the trend-right, premium footwear and apparel assortments our customers seek, which in turn has led to consistently outstanding financial results such as we announced today. Within the second quarter, we drove comparable sales gains across basketball, running, and classic footwear, as well as apparel. We also posted gains in all regions and channels in which we operate, reflecting the success of our strategic initiatives to build our Company to be an enduring retail leader with strengths across many dimensions.”

Year-To-Date Results

Net income for the Company’s first six months of the year increased to $318 million, or $2.33 per share, compared to net income of $303 million, or $2.14 per share, for the corresponding period in 2015. Earnings per share for the six-month period increased 8.9 percent compared to the same period in 2015. Year-to-date sales were $3,767 million, an increase of 4.3 percent compared to sales of $3,611 million in the corresponding six-month period of 2015. Year-to-date comparable store sales have increased 3.7 percent. Excluding the effect of foreign currency fluctuations, total year-to-date sales increased by 4.6 percent.

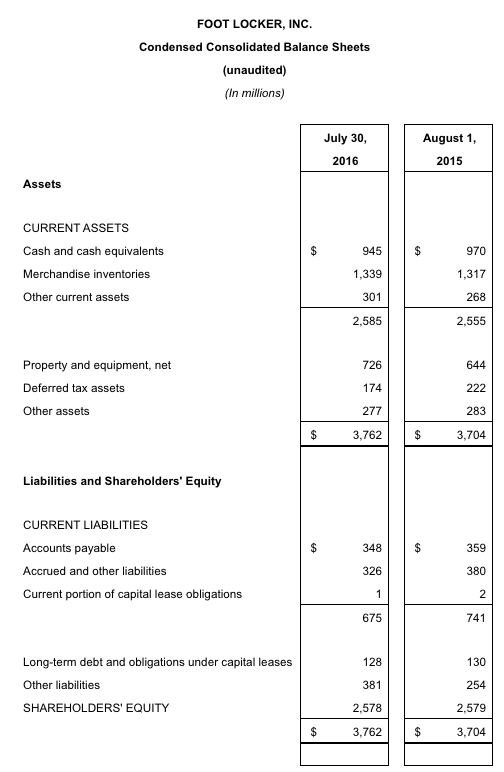

Financial Position

At July 30, 2016, the Company’s merchandise inventories were $1,339 million, 1.7 percent higher than at the end of the second quarter last year. Using constant currencies, inventory increased 1.9 percent.

The Company’s cash totaled $945 million, while the debt on its balance sheet was $129 million. The Company spent approximately $188 million to repurchase 3.35 million shares during the quarter and paid a quarterly dividend of $0.275, spending $37 million.

“The Company has made substantial and thoughtful investments in its stores, digital sites, and infrastructure over the years, which have led to significantly improved productivity,” said Lauren Peters, Executive Vice President and Chief Financial Officer. “The returns from those investments, combined with careful inventory and expense management, have led to our current strong financial position. This position of strength underpins our commitment to balance our allocation of capital between additional investments in the business and returning substantial amounts of cash to shareholders through our dividend and share repurchase programs, as evidenced by the $350 million of cash we have returned to shareholders in the first half of 2016.”

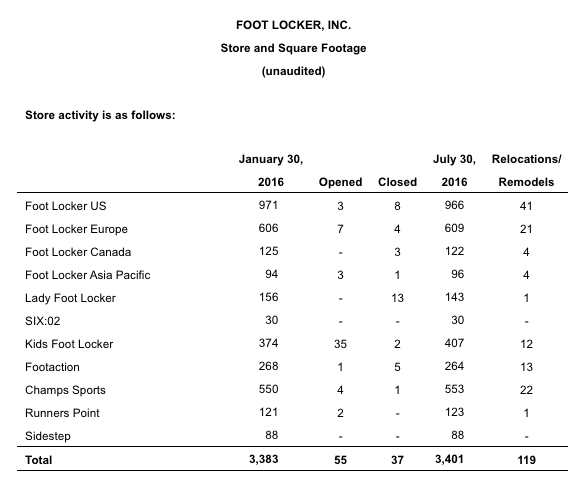

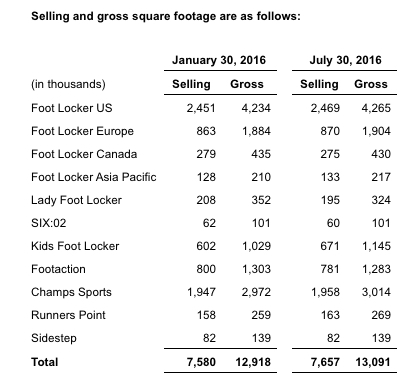

Store Base Update

During the second quarter, the Company opened 23 new stores, remodeled or relocated 64 stores, and closed 18 stores. As of July 30, 2016, the Company operated 3,401 stores in 23 countries in North America, Europe, Australia, and New Zealand. In addition, 54 franchised Foot Locker stores were operating in theMiddle East and South Korea, as well as 15 franchised Runners Point stores inGermany.

The Company is hosting a live conference call at 9:00 a.m. (EDT) today, August 19, 2016, to review these results, provide comments on the status of its current initiatives, and discuss trends in its business and the athletic industry. This conference call may be accessed live by dialing 1-800-916-9263 (U.S. andCanada) or +44 208-196-2881 (International), or via the Investor Relations section of the Foot Locker, Inc. website at http://www.footlocker-inc.com. Please log on to the website 15 minutes prior to the call in order to download any necessary software. A replay of the call will be available via webcast from the same Investor Relations section of the Foot Locker, Inc. website at http://www.footlocker-inc.com through September 2, 2016.

Source: PR

In essence it seems like the planned store moves were executed properly. Projections and plans for continued growth for next year’s Q2 results become the new challenge because these measures can’t really be repeated.

I wonder what AJ retro sales have been like with added production volume. While it carries less allure, seems more people on forums are picking stuff up successfully.

I’ve thought about the NYC 10’s as beaters, but those things are sort of a butt of a joke after some people were goofy enough to “stock up” on them